In spite of everything, too much borrowing can cause an overwhelming financial debt load and make repayment more challenging soon after graduation. It may also make the expense of your scholar loans more expensive, as you will have larger sized payments to deal with, Even though you receive a small amount with your loans.

Having said that, for those who can borrow money from your folks or family members, it is possible to often receive a very low or no-fascination personal loan. This established-up is a much better offer than almost all of the options mentioned previously mentioned.

As Absolutely everyone's marriage with their friends and family appears distinct, this will not be an choice for all borrowers.

Info A lot more details At Bankrate we attempt that can assist you make smarter economic choices. Even though we adhere to rigorous editorial integrity , this post could contain references to products and solutions from our associates. Here is an explanation for the way we make money .

So for anyone who is looking at Placing your fees with a charge card and know You cannot pay out them off straight away, you might want a bank card by having an introductory 0% APR.

Property fairness traces of credit score, often called HELOCs, are well known methods to borrow at desire charges Considerably reduce than most bank cards or particular loans can offer you since These are secured financial loans backed by your house as collateral.

Editorial Observe: We gain a Fee from associate backlinks on Forbes Advisor. Commissions usually do not have an effect on our editors' views or evaluations. Rapid own loans can provide adaptable financing to shoppers who need to access money quickly.

Repayment options: Your repayment phrases will be the length of check here time You will need to pay back your mortgage. Ordinarily, own loans offer you phrases in between just one and seven several years. Try to look for a bank loan which offers a range of options and suits your spending budget.

But Understand that you might not be accredited or your fees may well change if you do go forward. And Avant will complete a tough credit score Look at if you need to do apply, which could lessen your credit scores by a number of factors.

Lending rates generally will rise or drop as well as just what the Fed does, so if you anticipate to have a for a longer time repayment time period, it'd be a smart idea to wait around right up until later this year or upcoming calendar year for getting a private financial loan. The Fed is scheduled to fulfill again April thirty–May well 1. Positives and negatives of On line Loans

A borrower might be able to obtain superior or broader loan terms by turning to the world wide web versus only depending on lenders inside of It truly is almost Bodily home. Disadvantages of On the web Financial loans

On the other hand, it does signify that you're Placing your home up as collateral — you chance losing your property if it isn't repaid. When utilised properly, nevertheless, it will let you leverage the value you may have built in your home in a reduced desire rate.

Traditional banks may perhaps cost mortgage charges and often have greater desire premiums. Credit rating unions, Then again, typically have a lot more economical costs and charges.

Or, you could possibly borrow from the retirement cost savings. Specialists warning that this can be dangerous, having said that. If you receive laid off or alter jobs, repayment is frequently because of immediately, and borrowing from the retirement account could induce you to pass up out on advancement through the years.

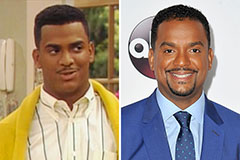

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Josh Saviano Then & Now!

Josh Saviano Then & Now! Romeo Miller Then & Now!

Romeo Miller Then & Now! Anthony Michael Hall Then & Now!

Anthony Michael Hall Then & Now! Kane Then & Now!

Kane Then & Now!